Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

Stocks retreated last week. Traders worried that the formal impeachment inquiry of President Donald Trump might distract White House officials from their pursuit of a trade deal with China and shift the focus of Congress away from consideration of the United States-Mexico-Canada Agreement (USMCA). Also, news broke Friday that the White House was considering restricting levels of U.S. investment in Chinese firms.

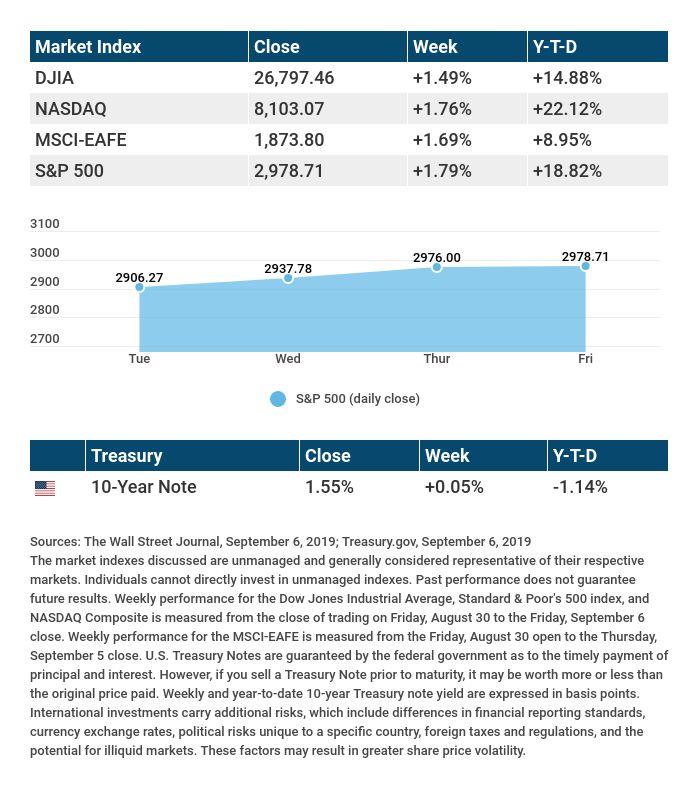

The Dow Jones Industrial Average lost less than the Nasdaq Composite and S&P 500. Blue chips declined 0.43% week-over-week, while the S&P fell 1.01%, and the Nasdaq dipped 2.19%. The MSCI EAFE index, tracking developed overseas stock markets, lost 0.89%.1,2,3

INCOMES GROW, SPENDING SLOWS

Data released Friday by the Bureau of Economic Analysis showed household incomes rising 0.4% in August. Consumer spending improved just 0.1% last month, however; that was the smallest advance in six months.

Another BEA report noted that “real” consumer spending (that is, consumer spending adjusted for inflation) rose 4.6% during the second quarter.4,5

A SLIP IN CONSUMER CONFIDENCE

The Conference Board’s Consumer Confidence Index fell to 125.1 for September. That compares to a reading of 134.2 in August. Lynn Franco, the CB’s director of economic indicators, wrote that “the escalation in trade and tariff tensions in late August appears to have rattled consumers. However, this pattern of uncertainty and volatility has persisted for much of the year and it appears confidence is plateauing.”

In contrast, the University of Michigan’s Consumer Sentiment Index ended September at 93.2, an improvement from a final August mark of 89.8.6,7

WHAT’S AHEAD

On October 10, the Social Security Administration is scheduled to announce the 2020 cost of living adjustment (COLA) for Social Security retirement benefits. Earlier this month, Bureau of Labor Statistics yearly inflation data pointed to a possible 2020 COLA in the range of 1.6%-1.7%.8

T I P O F T H E W E E K

When one or both spouses come into a marriage with considerable individual assets, a separate property trust may be worth considering, if only as a mechanism to try and insulate assets of one spouse from creditors of the other.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Institute for Supply Management presents its September Purchasing Managers Index for the factory sector, a barometer of U.S. manufacturing health.

Wednesday: ADP, the payroll processor, releases its September National Employment Report.

Thursday: ISM’s non-manufacturing PMI arrives, reporting on the state of the U.S. service sector.

Friday: The Department of Labor’s September jobs report appears, and Federal Reserve Chairman Jerome Powell gives a keynote speech at a Fed event in Washington D.C.

Source: Econoday, September 27, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Lennar (LEN), Paychex (PAYX)

Thursday: Constellation Brands (STZ), Costco (COST), PepsiCo (PEP)

Source: Zacks, September 27, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – cnn.com/2019/09/27/investing/dow-stock-market-today-oil/index.html [9/27/19]

2 – wsj.com/market-data [9/27/19]

3 – quotes.wsj.com/index/XX/990300/historical-prices [9/27/19]

4 – marketwatch.com/story/consumer-spending-barely-rises-in-august-as-americans-save-more-2019-09-27 [9/27/19]

5 – investing.com/economic-calendar [9/27/19]

6 – conference-board.org/data/consumerconfidence.cfm [9/24/19]

7 – marketwatch.com/story/consumer-sentiment-rebounds-in-september-but-americans-more-anxious-2019-09-27 [9/27/19]

8 – tinyurl.com/y2n8uvng [9/8/19]

CHART CITATIONS:

wsj.com/market-data [9/27/19]

quotes.wsj.com/index/XX/990300/historical-prices [9/27/19]

quotes.wsj.com/index/SPX/historical-prices [9/27/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [9/27/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [9/27/19]