The earlier you start saving, the easier it will be to send your kids to college

The month of August is when many parents are preparing to send children back to school this fall. While the checklists grow and the kids soak in the last few minutes of summer break, it’s important to remember college planning and back-to-school shopping. While getting an education can be difficult at times, paying for it can feel like climbing up an unending hill. More and more adults are going back to school, so this doesn’t just apply to kids.

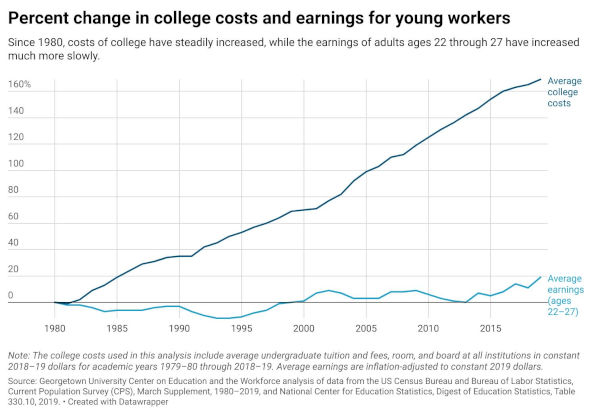

According to the U.S. Census, in the 40+ years since 1980, college costs have increased by 169% – while earnings for workers between the ages of 22 and 27 have increased by just 19%.

Rising Costs of College

Today, the average cost for college – which can include tuition, room and board, supplies, student loans and lost income can exceed $500,000. Consider these statistics:

-

The average private, nonprofit university student spends a total of $55,840 per academic year living on campus, $38,768 of it on tuition and fees.

-

The average cost of college in the United States is $36,436 per student per year, including books, supplies, and daily living expenses.

-

The average cost of college has more than doubled in the 21st century, with an annual growth rate of 2% over the past 10 years.

-

The average in-state student attending a public 4-year institution spends $26,027 for one academic year.

-

The average cost of in-state tuition alone is $9,678; out-of-state tuition averages $27,091

-

Considering student loan interest and loss of income, the ultimate cost of a bachelor’s degree can exceed $500,000.

Planning ahead for your children’s education can alleviate the burden on your family when you or your student must write a check or take out an education loan.

College Savings Plans

College savings plans offer many great benefits. For example, some taxpayers are eligible for a state income tax credit of up to 20% of contributions to a 529 account, which can add up to thousands of dollar per year. With a 529 plan, you put away money that grows tax-free, as long as you use it on education.

These types of savings accounts are also very flexible. Just because a student has a 529 account set up in Kansas, doesn’t mean the assets cannot be used to attend a school in California or Texas, as long as the institution is eligible under the specific 529 rules.

Many plans allow for hundreds of thousands of dollars per beneficiary to be held in a 529 account, with few income or age restrictions.

Another great benefit of a 529 is the donor retains control of the account and makes the decision for when withdrawals are made and for what reason.

Talk to Your Advisor

It’s important to consult an advisor or a 529 plan manager with specific questions regarding how each state’s plan works.

Back-to-school season is a great time to teach children and young adults about budgeting and giving priorities to certain purchases. While parents get ready for that time of the year where they make sure lunches are made and homework is completed, it’s wise to look ahead and begin, if they have not already, planning for their kids’ college education.

With rising tuition costs, the earlier you start planning and saving, the easier sending a child off to school can be.

Copyright © 2023 FMeX.