Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

Earnings helped give the Nasdaq Composite and S&P 500 a slight lift last week, offsetting investor disappointment over the small scope of the preliminary U.S.-China trade deal reached on October 11. Blue chips took a small weekly loss.

The Nasdaq and S&P respectively gained 0.40% and 0.54% on the week. The Dow Jones Industrial Average retreated just 0.17%. Outdoing these three benchmarks, the MSCI EAFE index tracking stocks in developed overseas markets rose 1.35%.1,2

THE EARLY EARNINGS PICTURE

According to stock market analytics firm FactSet, 15% of S&P 500 companies had reported results through Friday’s close. Of those companies, 84% announced that net profits topping projections, and 64% said that revenues had exceeded forecasts.

One big question is whether overall earnings for S&P 500 firms will show year-over-year growth. There was no year-over-year earnings gain evident in either Q1 or Q2.3

RETAIL SALES DECLINED LAST MONTH

Shoppers scaled back their purchases in September. The Census Bureau announced a 0.3% dip for retail sales, the first decrease in seven months.

Auto sales can influence this number, and car and truck buying fell 0.9% last month. A fall pickup in that category may help encourage another monthly advance.4

WHAT’S NEXT

If you buy your own health coverage, note that the open enrollment period for 2020 health insurance plans begins on November 1 in most states. The open enrollment window closes on December 15.5

T I P O F T H E W E E K

There are three distinct incentives to keep working in your sixties. One, your employer most likely offers you private health insurance and other medical benefits. Two, you can keep contributing to your retirement plan at work. Three, if you wait to claim Social Security at full retirement age, you will receive 100% of your monthly retirement benefit rather than a reduced amount.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The National Association of Realtors publishes a report on September existing home sales.

Thursday: A report on September new home sales arrives from the Census Bureau.

Friday: The University of Michigan’s final October Consumer Sentiment Index appears, evaluating consumer confidence levels.

Source: Econoday, October 18, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Celanese (CE), Halliburton (HAL), Sap (SAP), TD Ameritrade (AMTD)

Tuesday: McDonalds (MCD), Novartis (NVS), Procter & Gamble (PG), Texas Instruments (TXN)

Wednesday: Boeing (BA), Eli Lilly (LLY), Microsoft (MSFT), PayPal (PYPL)

Thursday: Amazon (AMZN), Comcast (CMCSA), Intel (INTC), Visa (V)

Friday: Anheuser-Busch (BUD), Verizon (VZ)

Source: Zacks.com, October 18, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – wsj.com/market-data [10/18/19]

2 – quotes.wsj.com/index/XX/990300/historical-prices [10/18/19]

3 – insight.factset.com/sp-500-earnings-season-update-october-18-2019 [10/18/19]

4 – reuters.com/article/us-usa-economy-retail/weak-u-s-retail-sales-cast-gloom-over-economy-idUSKBN1WV1NG [10/16/19]

5 – businessinsider.com/what-is-open-enrollment-your-opportunity-to-buy-health-insurance [10/15/19]

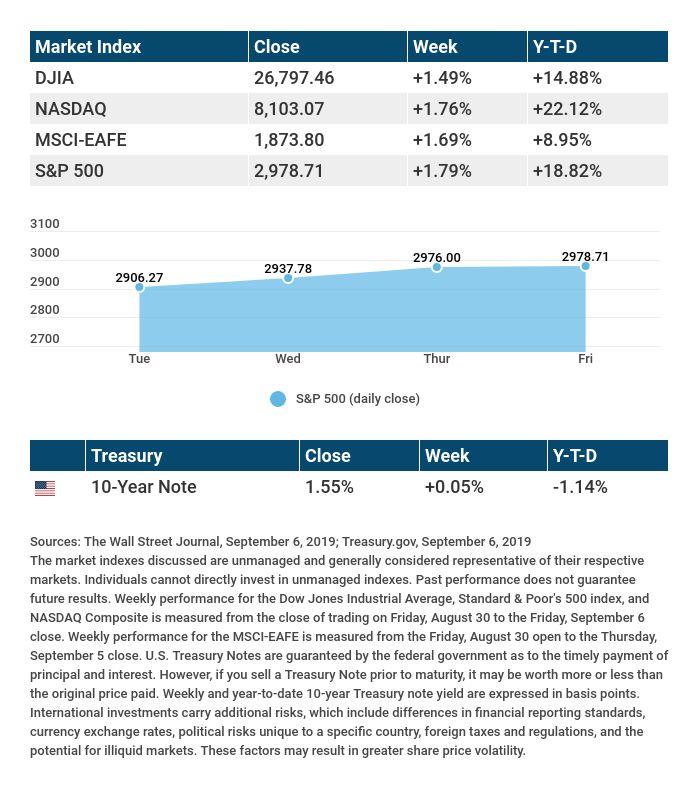

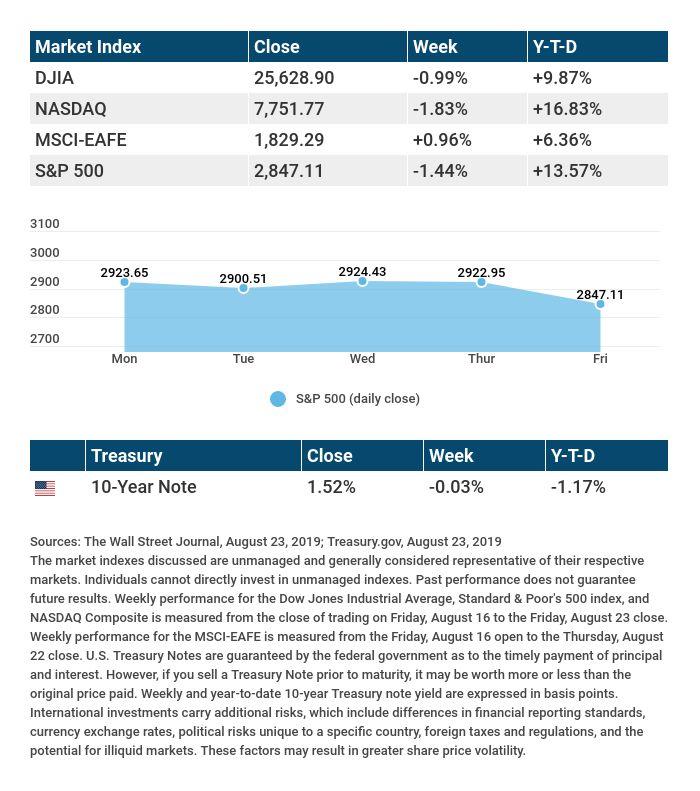

CHART CITATIONS:

wsj.com/market-data [10/18/19]

quotes.wsj.com/index/XX/990300/historical-prices [10/18/19]

quotes.wsj.com/index/SPX/historical-prices [10/18/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [10/18/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [10/18/19]