Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

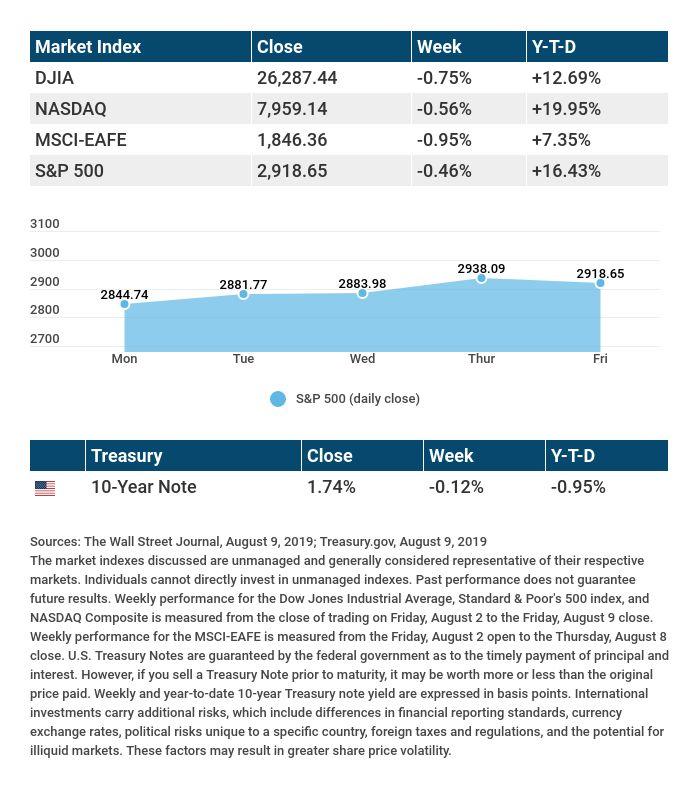

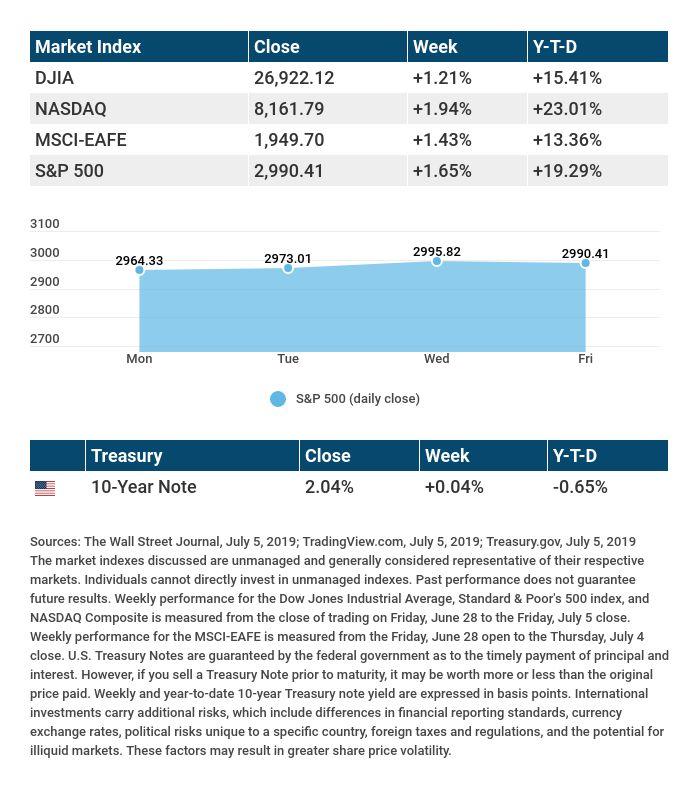

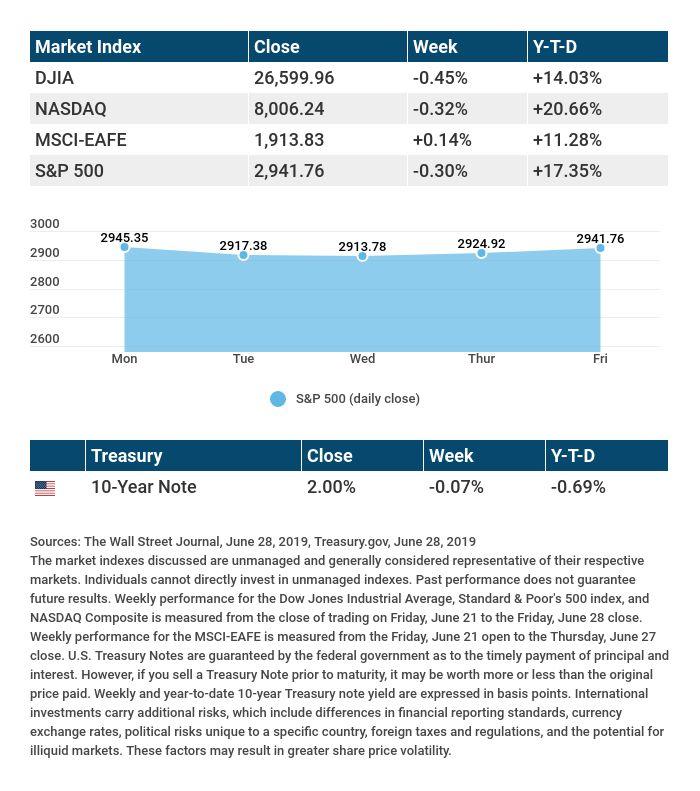

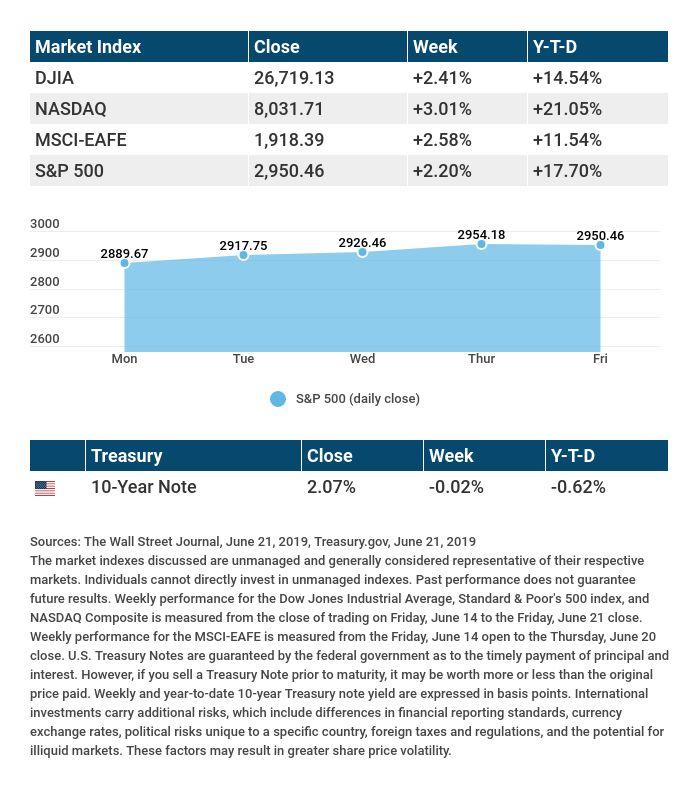

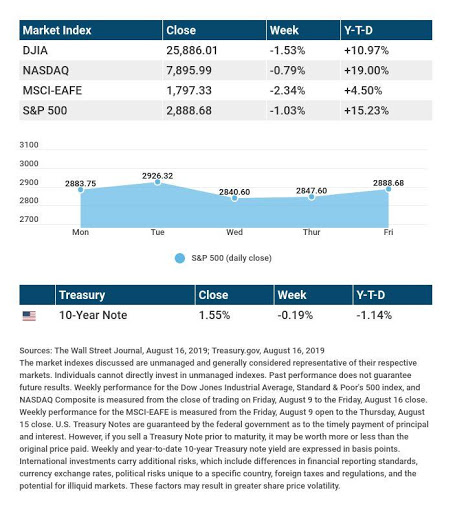

U.S. stock indices saw significant ups and downs last week, with traders looking for economic cues from Treasury yields and also developments in the tariff fight between the U.S. and China.

The S&P 500 lost 1.03% on the week; the Dow Jones Industrial Average and Nasdaq Composite respectively declined 1.53% and 0.79%. Overseas shares also retreated: the MSCI EAFE index lost 2.34%.1,2

ATTENTION ON THE BOND MARKET

Wednesday, the yield of the 2-year Treasury bond briefly exceeded that of the 10-year Treasury bond. When this circumstance occurs, it signals that institutional investors are less confident about the near-term economy. That view is not uniform. Asked whether the U.S. was on the verge of an economic slowdown, former Federal Reserve Chair Janet Yellen told Fox Business “the answer is most likely no,” noting that the economy “has enough strength” to avoid one.

The demand for bonds has definitely pushed prices for 10-year and 30-year Treasuries higher, and their yields are now lower (bond yields usually fall as bond prices rise). The 30-year Treasury yield hit a historic low last week.3,4

SOME CHINA TARIFFS POSTPONED

Last week, the Office of the U.S. Trade Representative announced that about half the Chinese imports slated to be taxed with 10% tariffs starting September 1 would be exempt from such taxes until December 15.

The White House said that the reprieve was made with the upcoming holiday shopping season in mind, so that tariffs might have less impact on both retailers and consumers.5

FINAL THOUGHT

Lower interest rates on bonds are now influencing mortgages. According to mortgage reseller Freddie Mac, the average interest rate on a conventional 30-year home loan was just 3.6% last week. That compares to 3.81% roughly a month ago (July 18).6

30-year and 15-year fixed rate mortgages are conventional home loans generally featuring a limit of $484,350 ($726,525 in high-cost areas) that meet the lending requirements of Fannie Mae and Freddie Mac, but they are not mortgages guaranteed or insured by any government agency. Private mortgage insurance, or PMI, is required for any conventional loan with less than a 20% down payment.

T I P O F T H E W E E K

If you do any freelance work, keep your freelance budget spending separate from your personal budget spending, for clarity at tax time and for a clearer view of your business expenses.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The minutes of the July Federal Reserve meeting and the latest existing home sales data from the National Association of Realtors.

Friday: Federal Reserve Chairman Jerome Powell delivers a speech at the Fed’s annual Jackson Hole economic conference on monetary policy, and July new home sales numbers arrive from the Census Bureau.

Source: Econoday / MarketWatch Calendar, August 16, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Baidu (BIDU), Estee Lauder (EL)

Tuesday: Home Depot (HD), Medtronic (MDT), TJX Companies (TJX)

Wednesday: Analog Devices (ADI), Lowe’s (LOW), Target (TGT)

Thursday: Salesforce (CRM), Intuit (INTU)

Source: Zacks, August 16, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – wsj.com/market-data [8/16/19]

2 – quotes.wsj.com/index/XX/990300/historical-prices [8/16/19]

3 – cnbc.com/2019/08/15/us-bonds-30-year-treasury-yield-falls-below-2percent-for-first-time-ever.html [8/15/19]

4 – foxbusiness.com/economy/janet-yellen-to-wall-street-a-recession-is-unlikely [8/14/19]

5 – reuters.com/article/us-usa-trade-china-tariffs/trump-delays-tariffs-on-chinese-cellphones-laptops-toys-markets-jump-idUSKCN1V31CX [8/13/19]

6 – freddiemac.com/pmms/archive.html [8/16/19]

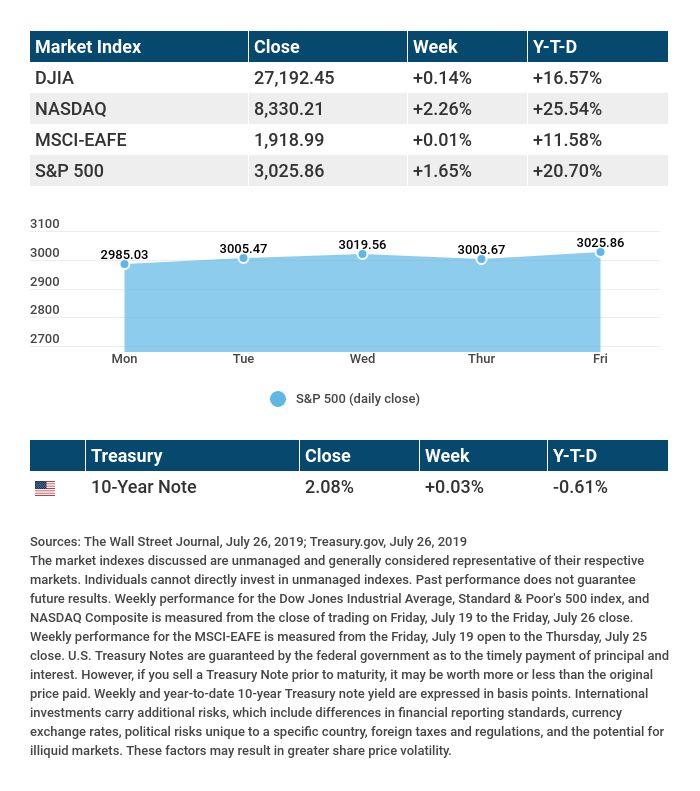

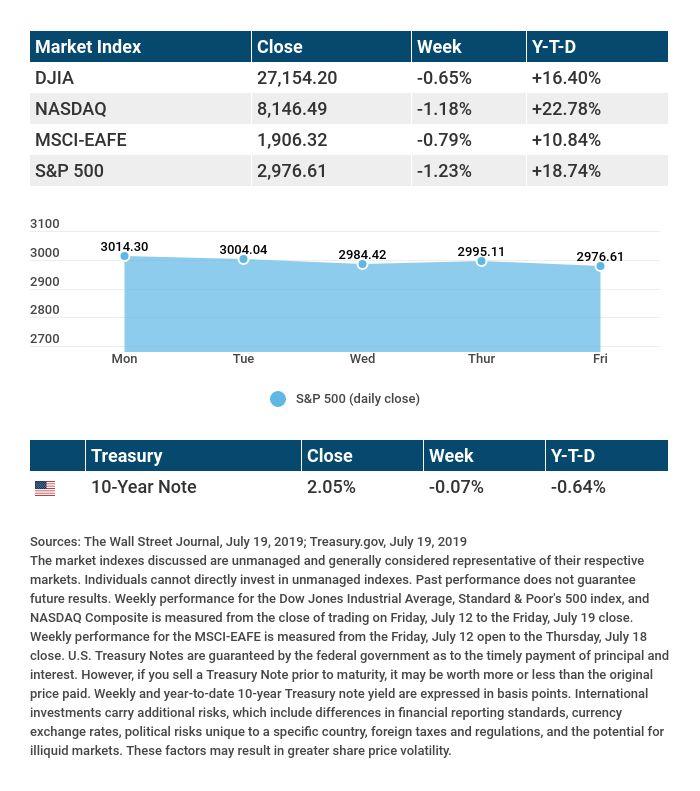

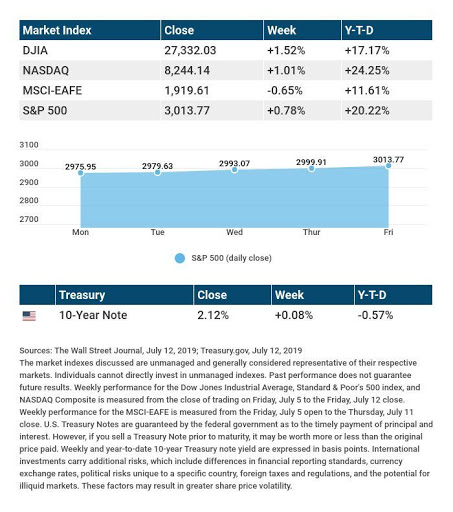

CHART CITATIONS:

wsj.com/market-data [8/16/19]

quotes.wsj.com/index/SPX/historical-prices [8/16/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [8/16/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [8/16/19]