Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

Stocks ended last week higher as volatility slowed, completing their best quarter since 2009. A Friday tweet from Secretary of the Treasury Steven Mnuchin encouraged investors, referring to “constructive” discussions in the ongoing U.S.-China trade negotiations.1

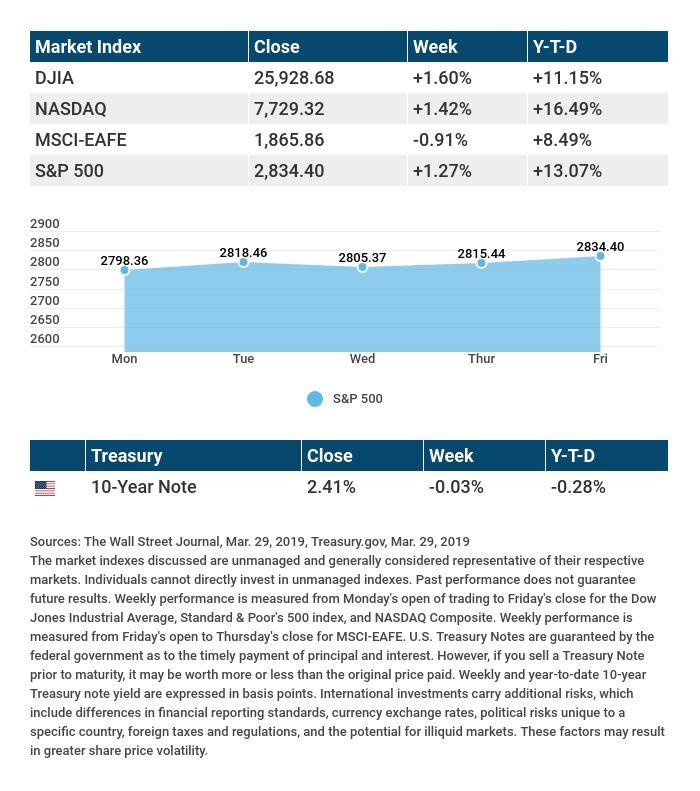

The S&P 500 gained 1.27% for the week. The Dow Industrials and Nasdaq Composite both exceeded that advance: the Dow rose 1.60%; the Nasdaq, 1.42%.2-4

Foreign shares went the other way. The MSCI EAFE index following international stocks retreated 0.91%.5

2019 COULD BE A BIG YEAR FOR IPOS

One of the ride-share pioneers, Lyft, closed on its initial public offering (IPO) on Friday, and a glance at the IPO calendar shows that as many as 226 companies could soon go public, with Uber and Airbnb possibly among them.6

This IPO wave may be a signal of a market top, or it may point to a comeback for risk appetite, which could be healthy for the overall market.

Should some big-name IPOs stumble, it may deter others from moving ahead, which may influence the market psychology. Conversely, an enthusiastic reception may help support further market advances.

[Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities.]

GOOD NEWS FOR THE HOUSING MARKET

The Fed’s dovish tone has also influenced home loan rates. Freddie Mac’s latest Primary Mortgage Market Survey shows an average interest rate of just 4.06% on a 30-year, fixed rate mortgage, compared with 4.28% a week earlier and 4.95% in December.7

This news is especially significant given the recent pickup in existing home sales. They jumped 11.8% in February, the biggest monthly gain in more than three years.8

[A 30-year, fixed rate mortgage is a conventional home loan meeting the lending requirements of Fannie Mae and Freddie Mac, but it is not a mortgage guaranteed or insured by any government agency. Private mortgage insurance, or PMI, is required for any conventional loan with less than a 20% down payment.]

TAX TIP

The federal income tax filing deadline is Monday, April 15. However, residents of Maine and Massachusetts have until Wednesday, April 17 to file their 2018 tax return. April 15 is Patriots’ Day, and April 16 is Emancipation Day.9

T I P O F T H E W E E K

Good debt (a home loan, a student loan) should be distinguished from bad debt (such as credit card debt with a high-interest rate). Strive to pay off bad debt as quickly as you can, and remember that much of it may be linked to purchases that reflect wants rather than needs.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: February retail sales.

Wednesday: ADP’s snapshot of March private sector hiring.

Friday: The Department of Labor’s March jobs report.

Source: Econoday / MarketWatch Calendar, March 29, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: GameStop (GME), Walgreens Boots Alliance (WBA)

Thursday: Constellation Brands (STZ)

Source: Morningstar.com, March 29, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – marketwatch.com/story/stocks-end-higher-sp-records-strongest-quarter-in-a-decade-2019-03-29 [3/29/19]

2 – quotes.wsj.com/index/SPX [3/29/19]

3 – quotes.wsj.com/index/DJIA [3/29/19]

4 – quotes.wsj.com/index/COMP [3/29/19]

5 – quotes.wsj.com/index/XX/990300/historical-prices [3/29/19]

6 – cnbc.com/2019/02/04/a-giant-ipo-wave-is-coming-as-unicorns-whet-investor-appetite.html [2/4/19]

7 – startribune.com/us-mortgage-rates-post-biggest-drop-in-decade-to-4-06-pct/507781302/ [3/29/19]

8 – nar.realtor/newsroom/existing-home-sales-surge-11-8-percent-in-february [3/22/19]

9 – efile.com/tax-day-deadlines/ [3/21/19]

CHART CITATIONS.

quotes.wsj.com/index/SPX [3/29/19]

quotes.wsj.com/index/DJIA [3/29/19]

quotes.wsj.com/index/COMP [3/29/19]

quotes.wsj.com/index/XX/990300/historical-prices [3/29/19]

markets.wsj.com [3/29/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [3/29/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [3/29/19]