Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

Daily headlines about the coronavirus had little impact on stock market averages last week. Earnings and mergers had more influence.

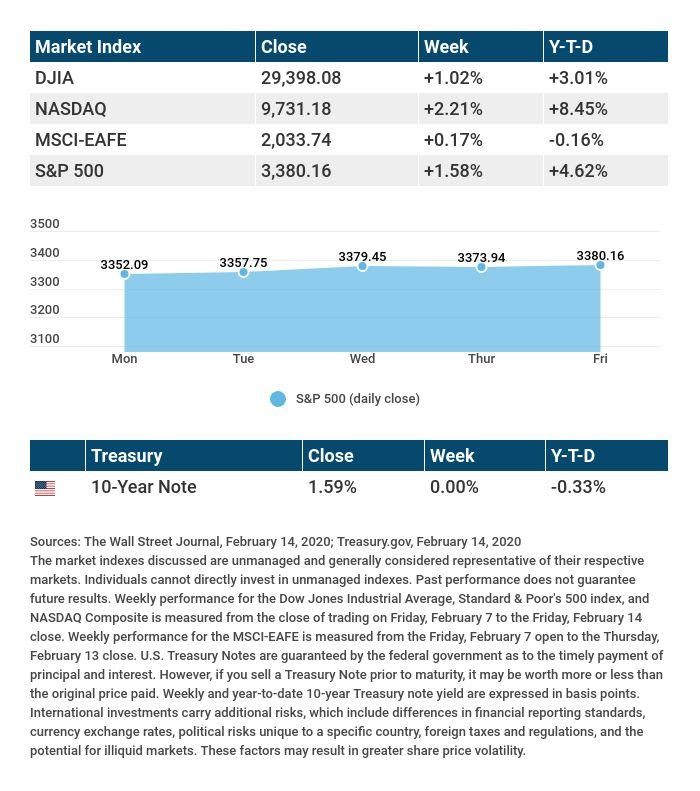

All three Wall Street benchmarks improved. The Nasdaq Composite rose 2.21%, outpacing the S&P 500, up 1.58%, and the Dow Jones Industrial Average, up 1.02%. The MSCI EAFE index, which tracks developed overseas equity markets, added 0.17%.1,2

JEROME POWELL TESTIFIES ON CAPITOL HILL

Commenting that the economy is in a “very good place,” Federal Reserve Chairman Jerome Powell told congressional legislators that he did not currently see a significant recession risk.

“There’s nothing about this expansion that is unstable or unsustainable,” Powell remarked during his semi-annual report to the House Financial Services Committee. He did reiterate that the central bank was “carefully” watching the coronavirus outbreak, and that it could “very likely” have residual economic impact on the U.S.3

YEARLY INFLATION REACHES 2.5%

Consumer prices have not advanced to this degree since the 12-month period ending in October 2018. Underneath this January headline inflation number, core inflation (minus food and energy prices, which are often volatile) was up 2.3% year-over-year.

These numbers are from the Consumer Price Index, maintained by the Bureau of Labor Statistics. The Federal Reserve monitors inflation using its core personal consumption expenditures (PCE) index, which remains below the central bank’s 2% yearly inflation target.4

GAINS IN RETAIL SALES, SENTIMENT

The Census Bureau said retail sales were up 0.3% in the first month of the year, matching the consensus forecast of analysts polled by MarketWatch. Additionally, the University of Michigan’s preliminary February consumer sentiment index monitoring consumer confidence factors went back above 100 last week (100.9).5

FINAL THOUGHT

The S&P 500 has risen more than 1% since the coronavirus surfaced. During the SARS epidemic of 2003, the MERS outbreak of 2013, and the 2015-16 Zika virus breakout, the index declined.6

T I P O F T H E W E E K

If you have accumulated multiple retirement plan accounts over the years, you may want to consider consolidating some of those balances into one account, as a move to simplify your retirement savings effort.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The Federal Reserve releases minutes from its January meeting, and the Census Bureau presents data on January residential construction activity.

Friday: The National Association of Realtors issues its latest existing home sales report.

Source: MarketWatch, February 14, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Medtronic (MDT), Walmart (WMT)

Wednesday: Analog Devices (ADI), NetEase (NTES)

Thursday: Dominos (DPZ), Hormel Foods (HRL), Southern (SO)

Friday: Deere & Co. (DE), Royal Bank of Canada (RY)

Source: Zacks.com, February 14, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – wsj.com/market-data [2/14/20]

2 – quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/14/20]

3 – tinyurl.com/tu8tre5 [2/11/20]

4 – cnbc.com/2020/02/13/us-consumer-price-index-rose-0point1percent-in-january-vs-0point2percent-expected.html [2/13/20]

5 – marketwatch.com/tools/calendars/economic [2/14/20]

6 – cnbc.com/2020/02/13/us-futures-point-to-lower-open-on-wall-street.html [2/13/20]

CHART CITATIONS:

wsj.com/market-data [2/14/20]

quotes.wsj.com/index/XX/MSCI%20GLOBAL/990300/historical-prices [2/14/20]

quotes.wsj.com/index/SPX/historical-prices [2/14/20]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [2/14/20]