Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

An open-ended commitment by the Federal Reserve to support American businesses and capital markets along with the passage of a $2 trillion aid package improved investor sentiment and drove a strong rally in stock prices.

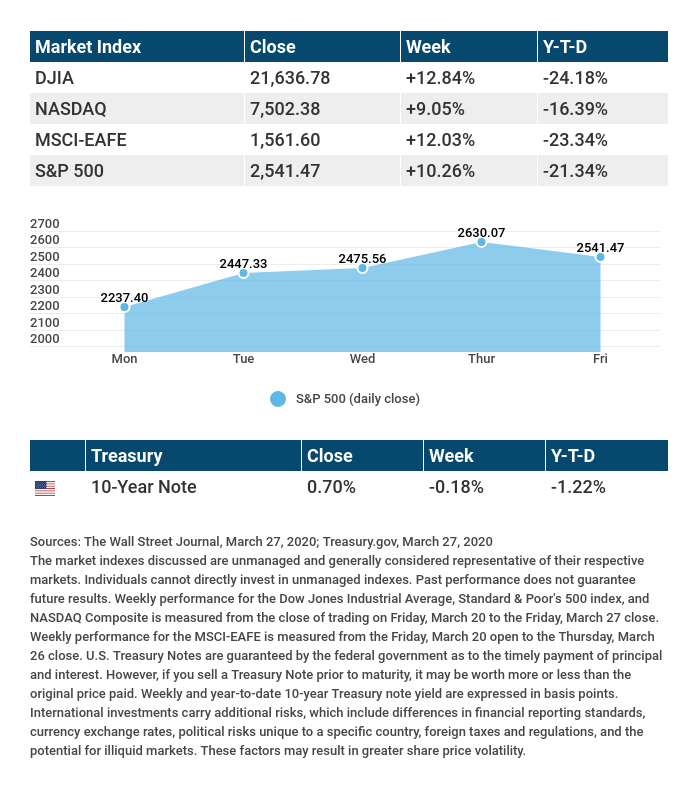

The Dow Jones Industrial Average jumped 12.84%, while the Standard & Poor 500 gained 10.26%. The Nasdaq Composite index rose 9.05% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased by 12.03%.1-3

STOCKS REBOUND

A stunning string of Federal Reserve initiatives and the passage of a $2 trillion aid bill buoyed stocks this week, with the Dow Jones Industrial Average jumping by over 11% on Tuesday, its best day since 1933. Stocks continued to strengthen the following day, registering their first back-to-back gains since February.4,5

Despite a record 3.28 million jobless claims, stocks added to their gains for a third straight day. Stocks gave back some gains on the final day of trading to end an otherwise welcomed week of positive price action.6

A SHIFT IN THE CONVERSATION

The conversation around the domestic spread of the coronavirus has been centered on “flattening the curve,” with closures of local businesses and schools, a shift to working from home, and appeals for social distancing.

Hitting the pause button on the U.S. economy, however, has had its consequences, including massive job losses, sharp declines in business revenues, and disarray in the capital markets. This week the conversation shifted to include how to restart the economy amid a pandemic that may not have yet peaked.

FINAL THOUGHT

On a strictly definitional basis, the three-day surge in stock indices this week signaled a new bull market (when stocks rise 20% after having fallen 20% or more). But it’s hard for even professional investors to make sense of a market that enters a bear market and a bull market in the same month. This volatility certainly speaks to the deep health and economic uncertainties that exist.

It’s not clear what the rally this past week means for the market going forward. Absent such clarity, markets are likely to remain volatile in the near term, requiring investors to be patient with their long-term investments and wait as calmly as possible for time to answer the big questions overhanging today’s market.

T I P O F T H E W E E K

Own a business? Negotiating with vendors may help you save a few hundred dollars in monthly operating costs. It doesn’t hurt to try it; any vendor would prefer a satisfied customer over a search for a new one.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: Automated Data Processing (ADP) Employment Report. Purchasing Managers Index (PMI): Manufacturing Index. Institute for Supply Management (ISM) Manufacturing Index.

Thursday: Jobless Claims for Unemployment. Factory Orders.

Friday: Employment Situation Report. Purchasing Managers Index (PMI): Services Index.

Source: Econoday, March 27, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Conagra Brands (CAG), McCormick & Co. (MKC)

Thursday: Walgreens Boots (WBA), Chewy (CHWY)

Friday: Constellation Brands (STZ)

Source: Zacks, March 27, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – The Wall Street Journal, March 27, 2020.

2 – The Wall Street Journal, March 27, 2020.

3 – The Wall Street Journal, March 27, 2020.

4 – CNBC.com, March 23, 2020.

5 – The Wall Street Journal, March 25, 2020.

6 – The Wall Street Journal, March 26, 2020.

CHART CITATIONS:

The Wall Street Journal, March 27, 2020.

The Wall Street Journal, March 27, 2020.

Treasury.gov, March 27, 2020.