Randy C. Benning, CFP Presents:

THE WEEK ON WALL STREET

The big story last week was the sudden grounding of Boeing 737 Max 8 and 9 passenger jets in dozens of countries. The financial effects of this ban could potentially impact the airline industry and segments of the economy for months.1

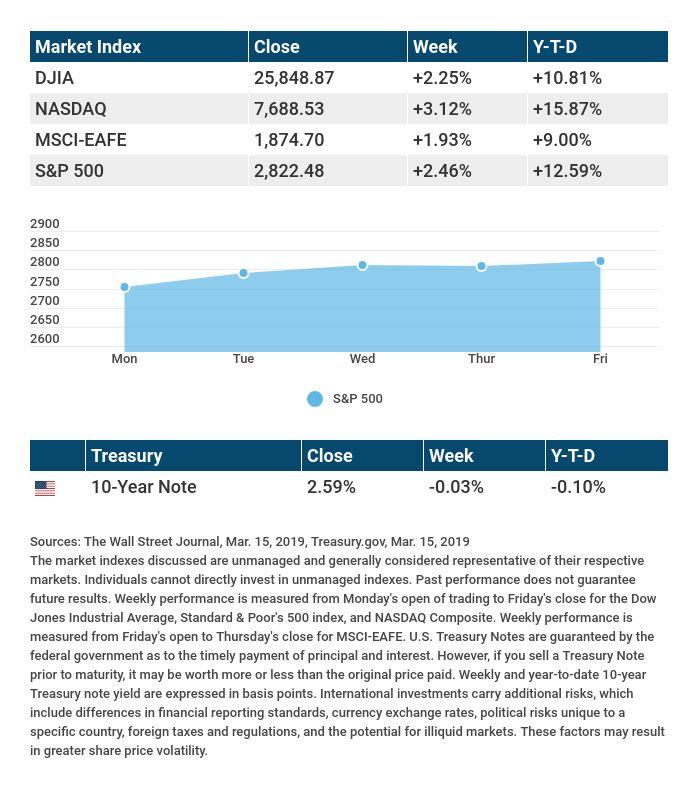

While the news created a headwind for the Dow Industrials, stocks managed to post solid gains for the week. The Nasdaq Composite rose 3.12%; the S&P 500, 2.46%; the Dow, 2.25%.2,3,4

Bullish sentiment was also evident overseas. Looking at the MSCI EAFE index, international stocks advanced 1.93%.5

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance.

TRADE MEETING DELAYED

Wall Street expected President Trump and Chinese President Xi to discuss trade issues this month. Thursday, Bloomberg reported that their talk had been postponed, with no firm date ahead.6

MUTED INFLATION

The latest Consumer Price Index showed just a 1.5% rise in overall consumer costs in the year ending in February.

This number does not suggest an overheating economy. During a 60 Minutes interview last week, Federal Reserve Chairman Jerome Powell said the central bank did “not feel any hurry” to make a rate move.7

TAX TIP

If you turned 70½ last year, April 1 is your final deadline to receive your initial Required Minimum Distribution (RMD) from a traditional IRA, SEP-IRA, SIMPLE IRA, or employer-sponsored retirement plan. If you take your initial RMD from these retirement accounts this year, you must receive your second RMD from them by December 31, 2019.8

Withdrawals from traditional IRAs, SEP-IRAs, and SIMPLE IRAs are taxed as ordinary income and, if taken before age 59 1/2, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70 ½, you must begin taking required minimum distributions from these plans.

T I P O F T H E W E E K

If it seems you will retire before you are eligible for Medicare, be sure to make the most of your employee health benefits. Schedule doctor, optometrist, and dentist check-ups as well as any major procedures needed. Paying for this health care out of pocket could be hugely expensive, and the premiums for private insurance could be costly.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: The Federal Reserve wraps up its two-day policy meeting.

Friday: February existing home sales.

Source: Econoday / MarketWatch Calendar, March 15, 2019

The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: FedEx (FDX), Michaels Companies (MIK)

Wednesday: General Mills (GIS), Micron Technology (MU)

Thursday: ConAgra Brands (CAG), Darden Restaurants (DRI), Nike (NKE)

Source: Morningstar.com, March 15, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Randy C. Benning, CFP®, President, License # 0816882, Benning Financial Group, LLC. Investment Advisory Services offered through Benning Financial Group, LLC, A Registered Investment Advisor, Benning Financial Group, LLC

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – cnbc.com/2019/03/13/boeing-shares-fall-after-report-says-us-expected-to-ground-737-max-fleet.html [3/13/19]

2 – quotes.wsj.com/index/SPX [3/15/19]

3 – quotes.wsj.com/index/DJIA [3/15/19]

4 – quotes.wsj.com/index/NASDAQ [3/15/19]

5 – quotes.wsj.com/index/XX/990300/historical-prices [3/15/19]

6 – bloomberg.com/news/articles/2019-03-14/china-u-s-said-to-push-back-trump-xi-meeting-to-at-least-april [3/14/19]

7 – reuters.com/article/us-usa-economy-inflation-idUSKBN1QT1MF [3/12/19]

8 – irs.gov/newsroom/tax-time-guide-seniors-who-turned-70-and-a-half-last-year-must-start-receiving-retirement-plan-payments-by-april-1 [3/5/19]

CHART CITATIONS:

quotes.wsj.com/index/SPX [3/15/19]

quotes.wsj.com/index/DJIA [3/15/19]

quotes.wsj.com/index/NASDAQ [3/15/19]

quotes.wsj.com/index/XX/990300/historical-prices [3/15/19]

markets.wsj.com [3/15/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [3/8/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [3/8/19]